The Trump administration will consider whether to alter the scope of tariffs on car parts, steel and aluminum and certain levies on imports from China, per Federal Reserve notices published this week.

The notices detail the process by which federal agencies will accept public input and decide which items to add to the list of products currently subject to Section 232 levies on car parts, steel and aluminum.

Separately, the Commerce Department is initiating its regular review of exclusions to Section 301 tariffs on imports from China installed during President Donald Trump’s first term.

The moves related to Section 232 tariffs represent a sea change for how the White House reviews duty modifications, according to a client alert from law firm Clark Hill. Previously, importers were allowed to apply for exemptions from Section 232 levies, but President Donald Trump eliminated the exclusion process in February.

“For years, the story of Section 232 was about carve-outs as importers could petition for exclusions from tariffs,” per Clark Hill.

Expanding the tariffs could boost domestic suppliers as the Trump administration continues its push to reshore production, according to Jonathan Todd, vice chair of transportation and logistics at Benesch Friedlander Coplan & Aronoff.

“There is clear, stated interest by the administration in driving domestic production of steel and aluminum and their derivative parts, and also driving domestic production of automotive parts,” Todd said.

Introducing an inclusion process for Section 232 duties could put importers at risk of contending with “a rippling, potentially endless expansion,” according to Alexander Schaefer, a partner in the international trade group at Crowell & Moring.

“There starts to be an arbitrage, where people who are bringing in some components, but not all, try to gain leverage against people who are bringing in a higher proportion of components,” Schaefer said. “It's all just sort of this commercial infighting.”

The notices also serve as a reminder of the myriad tools at a U.S. president’s disposal to enact duties as a Supreme Court ruling looms on the legality of Trump’s use of the International Emergency Economic Powers Act to install sweeping import fees.

Here are the key details of each notice.

1. Auto parts tariff inclusion process

The Commerce Department and the International Trade Administration this week published a final rule detailing the process that will be used to consider an expanded roster of items subject to Section 232 duties on auto parts. The Commerce Department established the rule in June in adherence to the executive order imposing the levies. This is the first time the rule has been made public.

Starting Oct. 1, the ITA will open a two-week comment period for domestic carmakers and other interested parties to submit requests to add to the list of goods subject to 25% auto parts tariffs. The agency will hold similar comment periods each January, April, May and October, per the rule notice.

Through the process, the tariffs on auto parts could grow to include goods like wire harnesses and upholstery used in car production but would not be considered auto parts under traditional Harmonized Tariff Schedule headings, according to Schaefer.

Stakeholders must submit information detailing the description of the proposed item, explaining why it should be considered an auto part and describing how imports threaten national security. The ITA will use these factors to determine whether the product should be subject to tariffs within 60 days. From there, the agency will work with U.S. Customs and Border Protection to establish an effective date.

“It is important that manufacturers supporting both the commercial vehicle industry and the defense sector have the opportunity to identify new and emerging automotive products with importance for defense applications to be considered under the scope of this action,” the notice says, noting the rise of autonomous vehicles and other advanced technology.

The rule notice also sets a Nov. 3 deadline for comments to be submitted about the rule itself.

“The automotive supply chain is complex, and changes in trade rules are likely to introduce new variables, including tariff stacking, compliance under USMCA, and sudden shifts in cost structures,” per Clark Hill’s client bulletin. “For manufacturers and suppliers, the risks are immediate and the consequences complex.”

2. Steel and aluminum tariff inclusions

The White House is also seeking public input about additional products to include on the list of goods covered by Section 232 steel and aluminum tariffs. After introducing the inclusion process this spring, the Trump administration later expanded the scope of the duties in August, adding over 400 new products.

“For some importers, the section 232 duties on derivative products may come as a surprise long after the time they place an order, when the products finally arrive to a U.S. port,” said Kelsey Christensen, a senior attorney at Clark Hill.

Importers have until Sept. 29 to submit inclusion requests for products and derivatives not already covered under the 50% duties on such goods. Per the final rule implementing the levies, the Commerce Department must open a two-week comment window three times a year in January, May and September.

“These are globally applied and ostensibly justified under national security,” said Deborah Elms, head of trade policy at the Hinrich Foundation, of the Section 232 levies in a LinkedIn post. “They are unlikely to be struck down or adjusted by the courts or Congress. But of most concern, they keep expanding in coverage.”

3. Exclusions for Section 301 tariffs on China imports

Beyond sector-specific duties, the White House is opening the review process for current exclusions to Section 301 tariffs on imports from China. To weigh in on the 178 product categories not covered by the levies, stakeholders can submit comments to the Office of the U.S. Trade Representative until Oct. 16.

The USTR will evaluate each excluded product on “a case-by-case basis,” per the notice. Factors the agency will consider include availability of goods from non-China sources, development of production in the U.S. or other countries and whether maintaining the exclusion will aid in shifting sourcing out of China.

“In addition, USTR will consider whether further extending the exclusion is consistent with the Administration’s priorities and how further extending the exclusion will impact U.S. interests, including the overall impact of the exclusion on the goal of obtaining the elimination of China’s acts, policies, and practices covered in the Section 301 Investigation,” the notice says.

The current list of exclusions features certain solar cell manufacturing equipment, air and water filtration machinery and some foodstuffs, among other items. The list was established in 2024 under the Biden administration following a four-year review of 25% duties originally implemented during President Donald Trump’s first term. The USTR has twice extended the exclusions this year, with the latest action, taken earlier this month, maintaining the list until Nov. 29.

The Section 301 tariffs are separate from the current 30% duties the U.S. is imposing on imports from China during an ongoing trade truce between the two countries. Those 30% levies combine a baseline 10% rate and a 20% charge tied to fentanyl trafficking.

Earlier this year, the U.S. hiked the tariff burden on goods from China to at least 145% during a back-and-forth trade dispute. The two countries have since agreed to reduce tariffs to accommodate trade discussions. The current agreement is set to expire Nov. 10, the same month the Supreme Court will hold a hearing to evaluate the legality of Trump’s use of the IEEPA to impose tariffs.

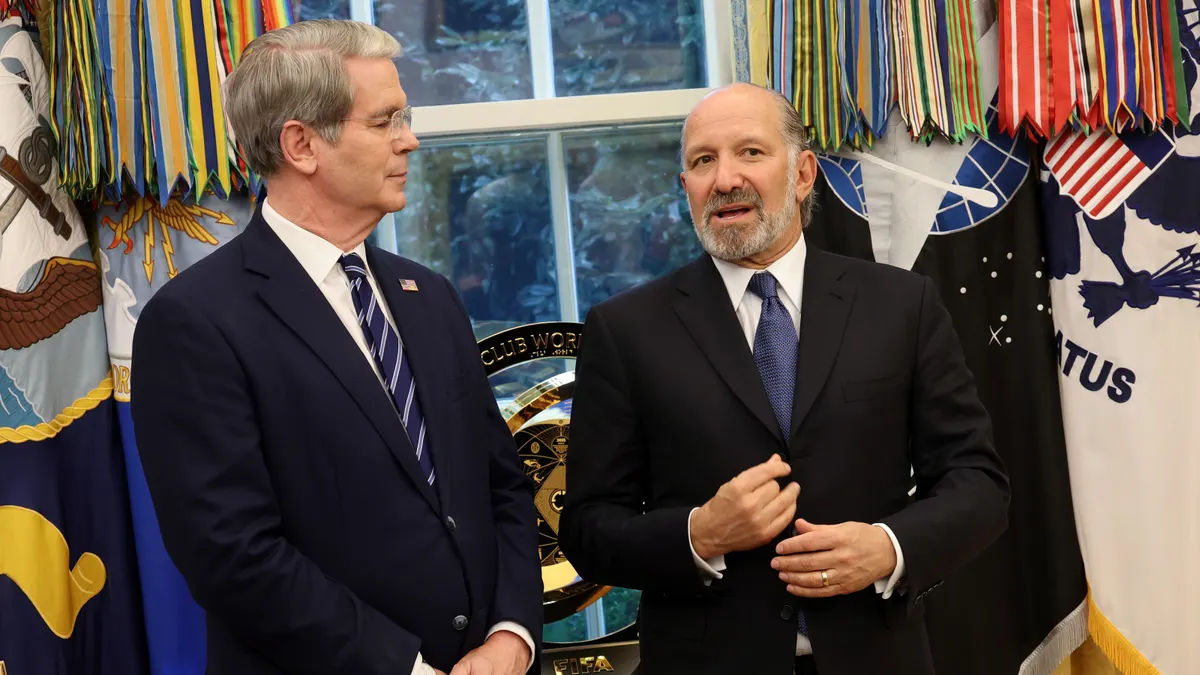

In the interim, White House officials have met with representatives from Beijing, including discussions in Madrid last week led by U.S. Treasury Secretary Scott Bessent.

“Each one of those talks has become more and more productive,” Bessent told CNBC’s Squawk Box on Tuesday, noting that the two sides will meet again in November. “I think the Chinese now sense that a trade deal is possible.”

Landing a more permanent agreement with China would add to the list of trading partners with which the U.S. has secured tariff-related deals following the initial rollout of country-specific duties by the Trump administration.

Several of those deals have yet to be formally enacted, but provisions from some agreements have gone into place. For example, the U.S. began applying a 15% tariff on imports from Japan on Tuesday as part of its deal with the country, per a notice from U.S. Customs and Border Protection.