President Donald Trump has changed the implementation date for tariffs on trucks.

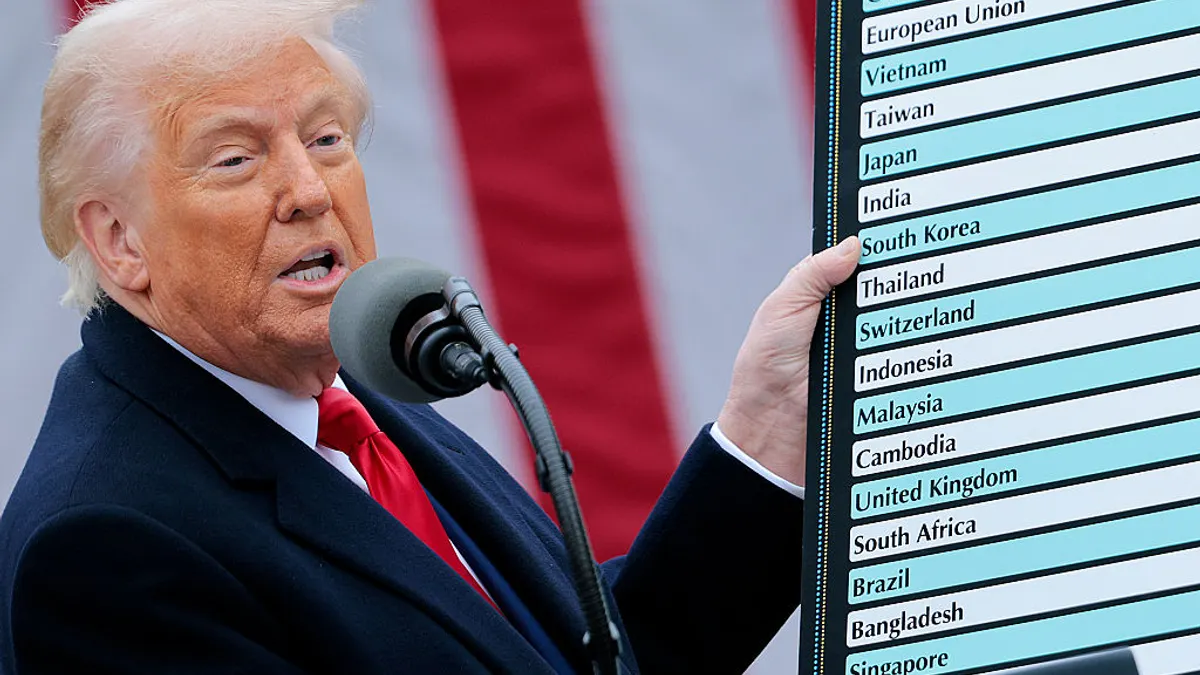

On Monday, the president said he plans to install a 25% tariff on heavy- and medium-duty trucks, starting Nov. 1, per a Truth Social post.

Trump previously indicated that the levies would begin at the start of October, along with duties on furniture and branded pharmaceutical products.

Tariffs on furniture, as well as timber and lumber, are set to go into effect Oct. 14, per an executive order Trump signed last week. There has yet to be official documentation for tariffs on pharmaceuticals and trucks.

The two truck tariff announcements do not appear to pertain to separate levies, but the White House press office didn't immediately return a message seeking comment.

Monday’s announcement creates a new timetable for both heavy- and medium-duty trucks. In April, the White House opened a Section 232 investigation into imports of such vehicles. Similar reviews have previously heralded tariff actions on goods, including steel and auto parts.

Trump did not provide any additional details publicly on Monday, including whether the new duties would stack on top of previously enacted levies or how tariff deals with trading partners like the European Union and Japan might be affected, if at all.

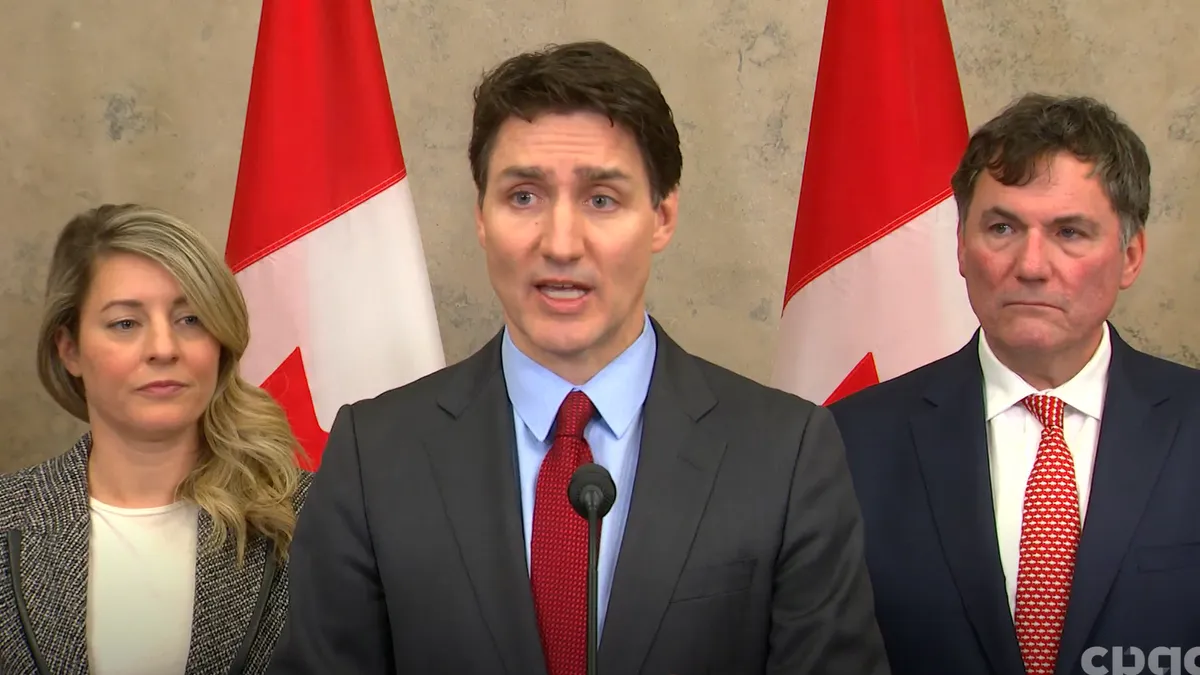

Mexico and Canada accounted for over 90% of truck imports to the U.S. last year, according to Jason Miller, a professor of supply chain management at Michigan State University.

In an August letter, the United Auto Workers wrote to Commerce Secretary Howard Lutnick in support of a Section 232 investigation of medium- and heavy-duty trucks, saying heavy truck imports have grown by over 40% since the onset of the North American Free Trade Agreement. UAW leaders said multiple OEMs produce most of their trucks in Mexico.

Miller estimates that approximately 42% or maybe even 50% of heavy trucks in the U.S. are accounted for by imports.

“Common sense then tells you there is no chance in the near-term for domestic output to handle all domestic demand,” Miller said in a LinkedIn post Monday, noting that new tariffs would be another headwind for an industry already suffering from declining freight rates.