Dive Brief:

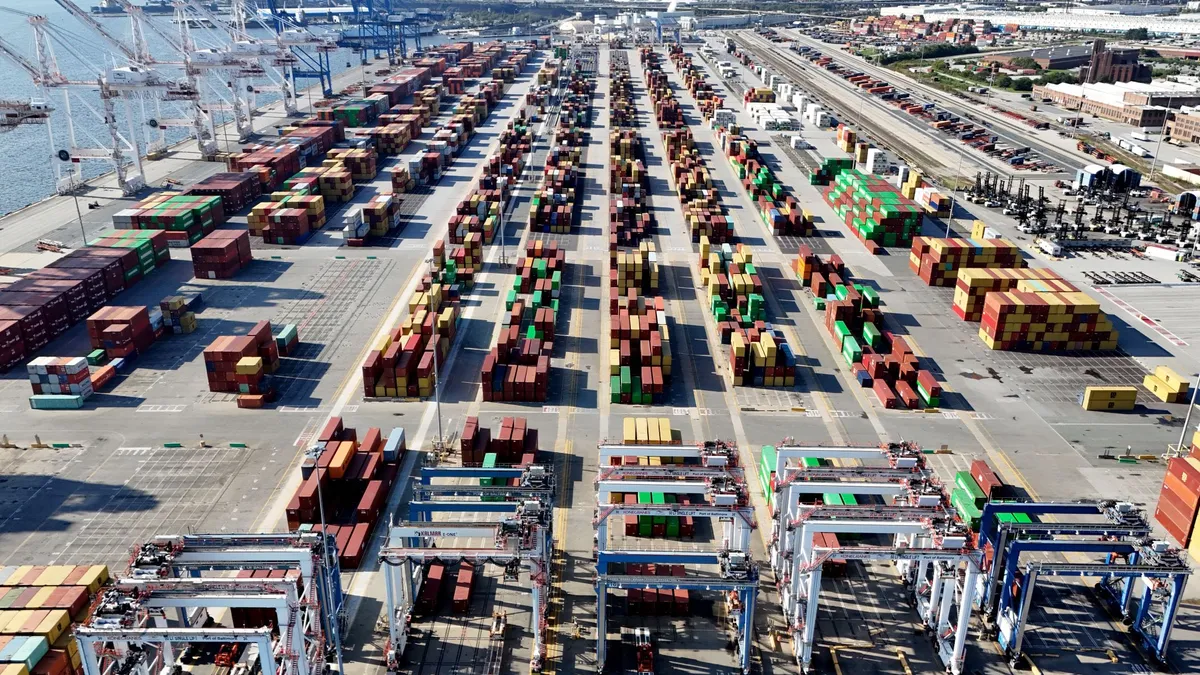

- Ocean rates on Transpacific trade lanes saw a week-over-week jump at the start of the year, Freightos Head of Research Judah Levine wrote in a Jan. 6 weekly update.

- Growing Lunar New Year demand and general rates increases from carriers are supporting the spike, with prices from Asia to the U.S. West Coast up 22% week over week to $2,617 per forty-foot equivalent unit.

- Rates from Asia to the U.S. East Coast, meanwhile, stood at $3,757 per FEU, up 12% week over week, per Freightos.

Dive Insight:

Transpacific container rates have been climbing in recent weeks. Currently, rates from Asia to the U.S. West and East Coast are 30% and 20% higher than mid-December, respectively, Levine reported.

While rates still followed an upward trend at the end of December, the increase wasn't as significant. In a Dec. 30 weekly update, Freightos reported rates from Asia to the U.S. West and East Coast up 1% and 10% week over week, respectively.

The steady climb ahead of the Lunar New Year holiday contrasts against rate levels earlier in the year. In October, for instance, ocean rates hit their lowest levels since late 2023 when the Red Sea crisis began impacting the industry. During the week of Oct. 8 through Oct. 15, Transpacific container rates fell 8% week over week.

However, even if demand continues to gain traction ahead of the Lunar New Year holiday, volumes are still likely to remain muted year over year, per Freightos. 2026 volumes are projected to be down 10% compared to last year and, alongside capacity growth, will lower YoY rates on Transpacific trade lanes.

Likewise, in December the Port of Los Angeles Executive Director Gene Seroka said the West Coast port would likely see single-digit declines in YoY import volumes. Seroka attributed the forecasted slight dip to high inventories after months of shipper frontloading to beat tariffs.

Meanwhile, over the weekend the U.S. captured Venezuela President Nicolás Maduro, striking the city’s La Guaira container port in the process. Although La Guaira is the country’s second largest container port, volumes had reportedly already started shifting to container terminals in nearby Puerto Cabello due to instability. Overall, impacts from the La Guaira strike will likely not have significant ripple effects beyond Venezuela, Levine said.

Editor's note: This story was first published in our Logistics Weekly newsletter. Sign up here.