Strong supplier relationships, the kind that drive operational, financial and customer service performance, are at the forefront of successful supply chain management. These robust relationships, prevalent for some time in the manufacturing supply chain, are migrating into the retail and service sectors as well.

Simply, it is more effective for suppliers and customers to work together, leveraging shared goals and enhanced communication channels.

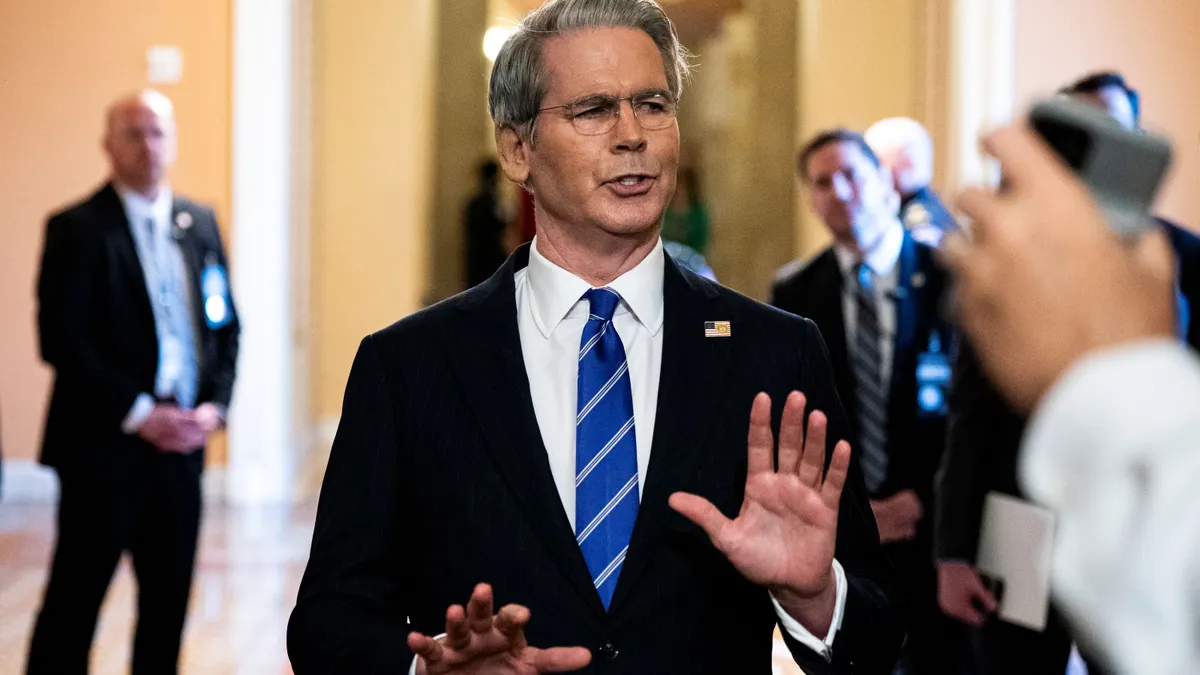

“We want to work together so the relationship is a win-win for both parties,” said Chris DeWolfe, logistics and inventory operations manager for United Pipe & Steel, the largest master distributor of pipe and tube products in the U.S. The company seeks to be the shipper of choice by having good communication with the carrier, laying out expectations, and understanding the challenges that they all face.

Carriers a key link in customer service

Carrier selection was at one time considered an afterthought, often managed through the back door by trucking representatives trying to curry favor directly with the shipping clerk. As the buyer traditionally absorbs transportation costs, the seller had little initiative to work on pricing and service issues. Most decisions on carriers to use, other than the traditional parcel and expedited services, were often based more on pick-up times and the relationship with the driver and the shipper than on customer needs.

Adding to the organizational ambivalence, most purchase orders indicated "best way" on the shipping instructions, ignoring cost or service requirements and diluting the transportation decision.

Today, there is increased understanding and acknowledgement of the role of carrier performance in the overall customer service equation.

From time-sensitive deliveries needed to support lean production lines, to multi-modal freight management supporting a global supply chain, to an online ordered sofa being delivered to a downtown condo, well managed logistics and transportation is vital.

Carriers become selective in picking shippers

With a high demand for freight transport, most experts agree these days that market conditions benefit the carrier. “Since mid to late 2017, the landscape has changed, and carriers are now ‘in the driver’s seat’,” said Wes Jayne, acknowledging the pun. He’s the associate manager of South Plainfield, New Jersey, based Hall’s Fast Motor Freight, a unit of Hall’s Logistics Group.

Jayne notes less carrier capacity due to increased demand, an aging driver workforce, and new electronic logbook regulations that have driven some companies and owner operators out of the industry. “Carriers for the first time, for as long as I can remember, are getting to be selective on the customers we choose to work,” he said.

Jayne says Hall’s has been lucky to have many long-term customers who have grown with them, from small LTL shippers to large capacity customers, using their FTL and LTL services. “Our customers work with Hall’s as much as their own buyers to understand their consignees’ schedules and to benefit from Hall’s freight management services,” said Jayne. Hall’s fleet of 75 trucks services the Northeast Corridor from Maine to Virginia.

"Since mid to late 2017, the landscape has changed, and carriers are now 'in the driver’s seat.'"

Wes Jayne

Associate Manager, Hall's Fast Motor Freight

Carriers like to select shippers who can maintain flexibility in their operations. “We’ve expanded receiving hours and appointments so drivers are not limited to certain receiving windows, and we’re also modifying our receiving procedures to better support the carriers,” said DeWolfe. In addition to paying his freight bills on time, DeWolfe also tries to maintain consistent volume with his transportation partners. “Regular demand for capacity goes a long way in maintaining the relationship.”

But even in a carrier’s market, trucking companies can’t falter in their performance. “In addition to communication breakdowns, I see occasional issues with trucking companies dropping and damaging loads, and not following even simple instructions around properly securing loads with tarps,” DeWolfe said. Additionally, he sees some companies coming up empty on their promises. “Many carriers have reached out to me and expressed their interest in becoming one of our carriers, claiming to have the capacity to move our freight. More often than not they fail, either with sky high rates or lack of equipment to move the load."

How shippers can woo carriers

How does a shipper become attractive to the carrier? In the case of both Jayne and DeWolfe, the answer seems to be in understanding what is going on in the transportation sector and taking a realistic approach to their respective businesses.

“We work with our customers to make sure they understand their consignees and the distribution region,” said Jayne. He tells of one customer who uses a third party broker from the Midwest, and how they continually question him about the time it takes to deliver trailer load deliveries in the New York City area. “Even though the computer shows the route is only 120 miles round trip, we know by experience that traffic, unloading times and weather issues can extend the delivery time to as much as 14 hours,” said Jayne. The reliance on computer based routing for mileage and fuel savings doesn’t always add up to being practical. “We like to say we’ve been in business since 1965 and operated in the Northeast Corridor with great success. Let us do what we know how to do."

As a shipper, DeWolfe tries to balance market realities with service needs. “While we occasionally get in the habit of looking for the lowest rate, sometimes you have to pay a bit more to get the best service,” he said. “We need to ensure that our loads are delivered in the allotted time frame and that they are with a carrier we can trust.”

Flexibility essential for small shippers

According to Jayne, Hall’s considers a small shipper as one who utilizes LTL services and ships one to three pallets per move, perhaps 2-3 times a week. While they only have a few of these small shippers in their customer mix, he says flexibility of the small shipper as key.

“In order to benefit from LTL consolidation, smaller shippers need to understand they have to be flexible to consignee receiving schedules and carrier delivery schedules, so they don’t feel the pressure of high costs to move their products,” said Jayne. “The days of sending a half full truck out to make a two stop LTL delivery are long gone, unless the shipper is willing to pay a significant charge for the service.”

Jayne said that when smaller customers approach a company like Hall’s they get their expertise in freight management. Similar products are pooled by temperature and weight, as well as coordinated requested delivery dates based on specific regions and consignee receiving requirements.

"While we occasionally get in the habit of looking for the lowest rate, sometimes you have to pay a bit more to get the best service."

Chris DeWolfe

Logistics and Inventory Operations Manager, United Pipe & Steel

DeWolfe knows that United Pipe & Steel’s volume is often not consistent enough for certain lanes where a carrier can dedicate equipment. He feels the key to getting the attention of the carrier community is to establish consistent demand. “While I can forecast the number of load per week, I sometimes have a hard time getting a handle on the timing of those loads and that impacts the carrier,” he said.

He notes that current market conditions are challenging to the small shipper, and sometimes even his best plans get sidetracked due to circumstances beyond his control. “I have a carrier that was consistently moving material within our highest volume lane, but the company that provided them with their backhaul went out of business,” said DeWolfe. “Since there is no material coming out of that area, it is not enticing for carriers to deliver there.”