Dive Brief:

- Pitney Bowes is narrowing its e-commerce fulfillment focus to lightweight parcels after taking in more volume than it could handle well last year, President and CEO Marc Lautenbach said on the company's Q2 earnings call.

- Pitney Bowes "tried to say yes to as many customers and as much volume as we could" as the COVID-19 pandemic accelerated online shopping growth, he said. But the company is now focusing on parcels it can deliver profitably and at high service levels: those weighing around 1 pound.

- "So as we go forward, we are very focused on handling the volume that we think we can do exceptionally well," Lautenbach said. "So that limits you to certain lanes where we've got capacity as the industry continues to be capacity constrained and, candidly, certain size parcels."

Dive Insight:

There's a surplus of parcels to go around nowadays for logistics companies handling e-commerce shipments. With demand not an issue, they're becoming more selective about the kinds of parcels they want in their networks to maximize efficiency and profitability. Parcel carriers FedEx and UPS, for example, are prioritizing higher-yielding volumes, like those from small- and medium-sized businesses and sectors with high-value shipments like health care.

Pitney Bowes, which has close ties with the Postal Service as its largest workshare partner and often uses it for last-mile delivery, is committing to a 1-pound "sweet spot" in its fulfillment network. This shift comes after fiscal year 2020 EBIT for its global e-commerce and presort services decreased 18% and 21% YoY, respectively, primarily due to higher transportation and labor costs to handle the volume surge, according to its 10-K.

"One of the things that happened last year is we got so much volume all at once, we had to throw a lot more cost at it both from a labor and transportation perspective," Lautenbach said.

In Q2, Pitney Bowes handled around 40 million to 45 million parcels, according to Lautenbach. The company expects volumes to increase in Q3 and Q4 as its customers begin to prepare for peak season. However, he added that Q4 volumes may be "slightly below last year" as the company narrows its focus.

"We're clearly going to try to accommodate as many clients as we can again this year, but we're going to do it in a way that we can have the highest commitment to service levels, at the same time, do it in a way that's economical and profitable to us," he said.

Pitney Bowes continues to build out its warehouse footprint as volumes rise, and it is in the process of opening two new sites and upgrading another ahead of peak. But it's tooling those new sites to handle the lightweight parcels the company is prioritizing, Lautenbach said.

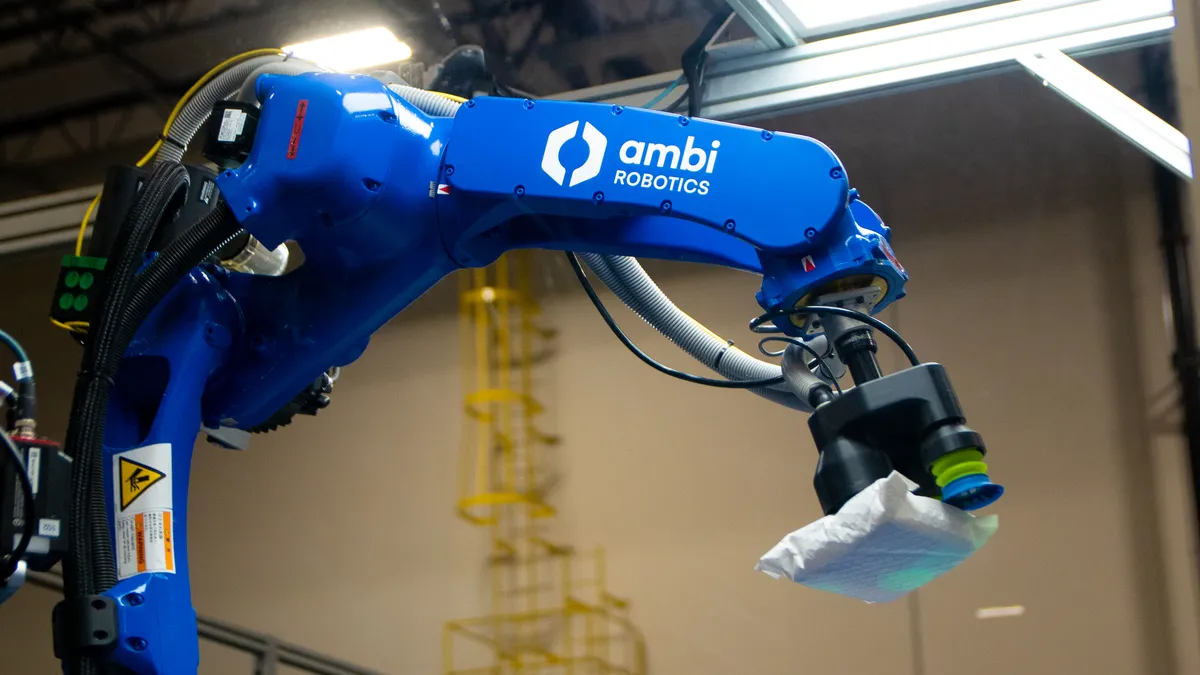

The company is also deploying automated parcel sorting systems from Ambi Robotics in its U.S. e-commerce hubs over the next five years, the company said in a June news release. The robotic sorters will increase the hubs' parcel sortation speeds.

CFO Ana Maria Chadwick said the sorters and other automation investments will take time to integrate, but added that the company is already seeing early benefits in these investments that will carry over into the peak season. In relation to its workforce, Lautenbach said as hourly labor costs rise, the company's focus is how to bring in "a more reliable labor base that stays with us and add automation to that."