New York City's 8.6 million people have drawn manufacturing capacity to the Bronx. They’ve drawn food distribution to the Bronx. And now, the e-commerce age has arrived.

One 200,000-square-foot facility along the Bronx River has shifted hands, after decades as a furniture distribution center, to Jet.com in 2018 to Amazon in 2020. A 700,000-square-foot cinema complex closed in 2012 will be a high-tech, two-story, last-mile facility.

"It was like overnight it just caught like fire across the borough," said Ed García Conde, founder and editor of local news site Welcome2TheBronx. But contending with New York real estate prices and infamous traffic makes the borough a fit for some e-tailers and a nightmare for others.

Bypassing bottlenecks

The influx of e-commerce tenants may feel recent to residents, but the Bronx has been coming up in the world of e-commerce logistics alongside Brooklyn, Queens and Staten Island. The rise was inevitable, according to Andrew Chung, CEO of Innovo Property Group, which is developing the cinema-turned-warehouse project. Chung likened the changes in the Bronx to the fourth industrial revolution — "the distribution revolution," he said.

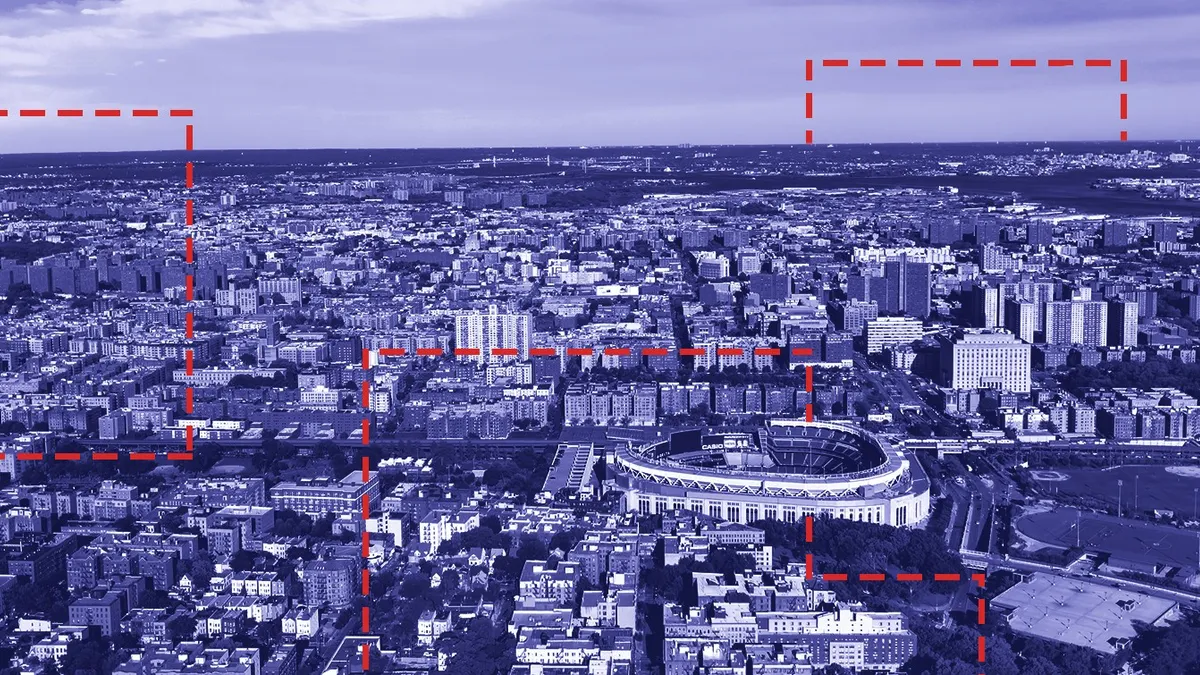

The Bronx’s primary industrial area is 3.5 miles from midtown Manhattan and 10 miles from downtown Manhattan. But convenience isn’t measured in miles in New York and the surrounding area.

"The Bronx has, like, 10 connections to Manhattan," Chung said, adding that this makes the location ideal for e-commerce operations on a tight schedule. "And, by the way, only one of those connections charges a toll," he said.

New York can be a hard nut to crack because it is surrounded by traffic bottlenecks, also known as bridges and tunnels. Being within the five boroughs help, but being in the Bronx helps more, Chung said. "There’s the reality of life part — just physics," Chung said. "You can't deliver from New Jersey same-day."

The Bronx is ideal for same-day or one-hour delivery to Manhattan, Jesse Harty, senior vice president and market officer for New York and New Jersey at Prologis, said in an email.

Working with the warehouse inventory

The Bronx’s storied industrial history has led to mixed industrial real estate inventory and a lack of open space.

"Despite a deep-seated need for efficient distribution centers, the existing industrial inventory in the Bronx is outdated and limits [users] ability to scale their businesses effectively," JLL Vice Chairman and Head of the Northeast Industrial Market Rob Kossar said in an email.

E-commerce warehouses need more open plans within facilities and more lot space outside to support more small-vehicle traffic than a traditional wholesale distributor.

"Despite a deep-seated need for efficient distribution centers, the existing industrial inventory in the Bronx is outdated and limits [users] ability to scale their businesses effectively."

Rob Kossar

Head of the Northeast Industrial Market, JLL

The Bronx’s industrial stock may be old and out of fashion, but don’t count it out, said Bradley Cohen, senior vice president at CBRE.

"The bricks are irreplaceable," Cohen said. "You’re not necessarily knocking these structures down because they serve their purpose. You don’t necessarily have to build ground up."

In former factories, developers can take out the offices to create a more open plan, free up the mezzanine level and end up with a perfectly good e-commerce warehouse, he said. "A lot of savvy investors have figured out how to make use of these existing buildings."

As of Q3, The Bronx had the most industrial square footage under construction of any outer borough at roughly 1 million square feet, according to CBRE.

Movement beyond the road

Traffic is a constant battle between stakeholders and city figures. Lisa Sorin, president of the New Bronx Chamber of Commerce, said dedicated trucking lanes for some of the busier industrial complexes may be on the way after 40 years of trying. Traffic was one reason the cinema project remained in limbo for years after closing in 2012, she said.

New York City has a plan to offer more than just road transport for goods. The $100 million Freight NYC plan includes the start of barge freight to move around the island. The city put out a request for proposals for a barge operator in early 2019. In September, a spokesperson from the New York City Economic Development Council said the organization is still evaluating responses. Plus CSX passes through. Another massive last-mile project in the South Bronx (this one 1.24 million square feet) has a rail spur, though this is the only one in the area, according to Real Estate Weekly.

"The Bronx has always been known for probably the best transportation … our roads weren’t up to par to be able to handle the trucking that comes with all of this," Sorin said. "I would say that the Bronx has better layout and opportunities for this type of transportation than any other borough. It just has not been used to its capacity."

Chung described the city as early in its e-commerce evolution, with facility conversions and road work yet to come. New York logistics aren’t for everyone, he said. You need order volume that’s contingent on speed. Lots of it.

Running the numbers on the last mile

New York City is a one-day ship zone (for most national carriers) from East Coast cities from Maryland to Massachusetts. So, how could the economics of city delivery from an outer borough make financial sense? Deloitte did the math.

In a report based on 2018 data, the consultancy ran the costs for potential last-mile scenarios including 3PL or van lease plus labor, tolls and fuel from multiple New Jersey locations to the city. It compared those with warehousing costs such as operating labor, parking and rent in the Bronx. The scenarios were run with the aim of a 4-hour delivery window.

Deloitte’s analysis found delivering e-commerce orders from the Bronx was 22% more cost-effective than from New Jersey, due to higher transportation costs getting in and out of the city. Plus, beyond last-mile delivery, warehouses within the five boroughs can help to replenish urban stores and process returns faster.

The delivery window is key in this scenario. Shippers without tight delivery windows likely wouldn't see the same benefit. But for same-day service, the advantage was clear.

"We expect demand to grow, particularly as new development spreads to other areas of the city and the Millennial cohort grows," Deloitte concluded.

Will changing times change priorities?

Some residents of the Bronx see the transition to the "distribution revolution" happening around them, and so far opinions are mixed.

García Conde worries that the borough’s health concerns, exacerbated by current truck traffic, will only worsen with the e-commerce onslaught. Air quality in the Bronx is worse (4%) than the city generally, but in warehouse-heavy areas such as Hunts Point, it's 13% worse, according to a community health survey from 2018.

"We’re always told that we’re going to get jobs, but we have to sacrifice something and it’s always the environment," he said.

Small businesses are also concerned that their new warehouse neighbors will contribute to their demise.

"We’re always told that we’re going to get jobs, but we have to sacrifice something and it’s always the environment."

Ed García Conde

Founder and Editor of Welcome2The Bronx

"Small businesses feel like they're being taken over by Amazon, which, of course, to some degree, they are," said Sorin. "But at the same time, there's an opportunity for businesses to figure out how they can change the dynamics of what they do." This is especially true now that the pandemic has had an outsized impact on communities of color, she said.

But the pandemic has also brought with it unemployment and may have changed the minds of those traditionally opposed to controversial companies like Amazon coming into the Bronx, according to Sorin. The unemployment rate in July for the borough was nearly 25% — the highest since the Great Depression.