Supply chain management trends to watch in 2025

Last year hammered home something clearly to supply chain professionals: disruption is the norm, rather than the exception.

Between increasing tariffs, labor unrest across several freight modes and multiple extreme weather events disrupting operations, companies faced an onslaught of challenges in 2024. Such disruptions have called for companies to continue forming more nimble and resilient supply chains, said Jess Dankert, VP of supply chain at the Retail Industry Leaders Association.

“The retailers are really more focused on what they can control, and that's their supply chains, and the supply chains that they've built to be responsive to disruptions,” Dankert said.

As companies gird themselves for this year’s potential disruptions, here’s a look at the trends that will shape 2025 for supply chain managers.

Diversification will be critical

Promised tariff hikes from President-elect Donald Trump and other geopolitical tensions have already led many companies to reshape their procurement networks to avoid an over reliance on single source supply bases. The moves build on years of sourcing shifts since Trump’s first term.

Countries such as Vietnam, Mexico and India experienced a dramatic rise in export activity to the U.S. between 2018 and 2024, per a December 2024 analysis from AlixPartners, while China experienced a 22% drop during the same time period.

This diversification trend will continue in 2025, particularly as companies pursue even more limited exposure to China amid mounting tariff pressure, said Jonathan Gold, VP of supply chain and customs policy for the National Retail Federation.

Meanwhile, other companies may rely more on third-party logistics providers to improve their diversification efforts, experts said

Expect automation and AI to accelerate

Automation within the warehouse environment will gain more ground in 2025, per experts, providing benefits such as improved inventory optimization and enhanced safety. However, an age of “dark warehouses,” or facilities run entirely with minimal to no human input, is not on the horizon.

“The retailers are really more focused on what they can control, and that's their supply chains, and the supply chains that they've built to be responsive to disruptions."

Jess Dankert

VP of Supply Chain, Retail Industry Leaders Association

For some segments, the push for more technologically advanced facilities could further incentivize companies to partner with 3PLs.

“Building warehouse capacity can be very capital intensive depending on levels of automation thus partnering with 3PLs who continue to add capacity and grow their networks can be an attractive course of action,” said Ron Scalzo, a senior managing director at FTI Consulting, in an email.

The application of AI is still far from universal in the supply chain ecosystem, but retailers and manufacturers are continuing to evaluate the technology, experts said, noting the potential benefits to be gained in terms of visibility and forecasting.

To really gain the potential benefits of new AI technology, however, companies must ensure they have quality data collection and analysis.

“Everybody's got a ton of data,” Dankert said. “It's just those who can use it better, and sort through it better and find the signal in the noise are the ones who are really the leaders in the space.”

Supply chain experience is now customer experience

Just as supply chains remained resilient in 2024, so did consumer spending. There was a 2.15% year-over-year increase in total retail sales through November, according to the National Retail Federation, even as inflation failed to slow as quickly as expected.

Although spending increased, shoppers have continued to illustrate more discerning buying patterns, particularly emphasizing value-oriented products, according to experts. That increased customer scrutiny is also extending to retailers’ supply chains.

“I think that attention has really helped shed light on the fact that supply chain isn't just a backroom kind of thing or warehouse kind of thing,” Dankert said. “It's very much kind of front and center with consumers, and something that is visible to consumers and important to consumers in many ways.”

With supply chains now more consumer-facing, particularly in the retail space, there is more pressure to create a holistic experience that meets the demand of individual shoppers. This will force retailers to ensure they are more precisely managing inventory so they can provide consistent experiences across their channels.

“Consumers may be shopping digital channels first, but they are back in stores and incredibly frustrated when pricing is inconsistent or they can’t find in-store what they saw online — they are tired of doing the work,” said Sonia Lapinsky, partner and managing director and leader of fashion retail at AlixPartners, in an October 2024 press release.

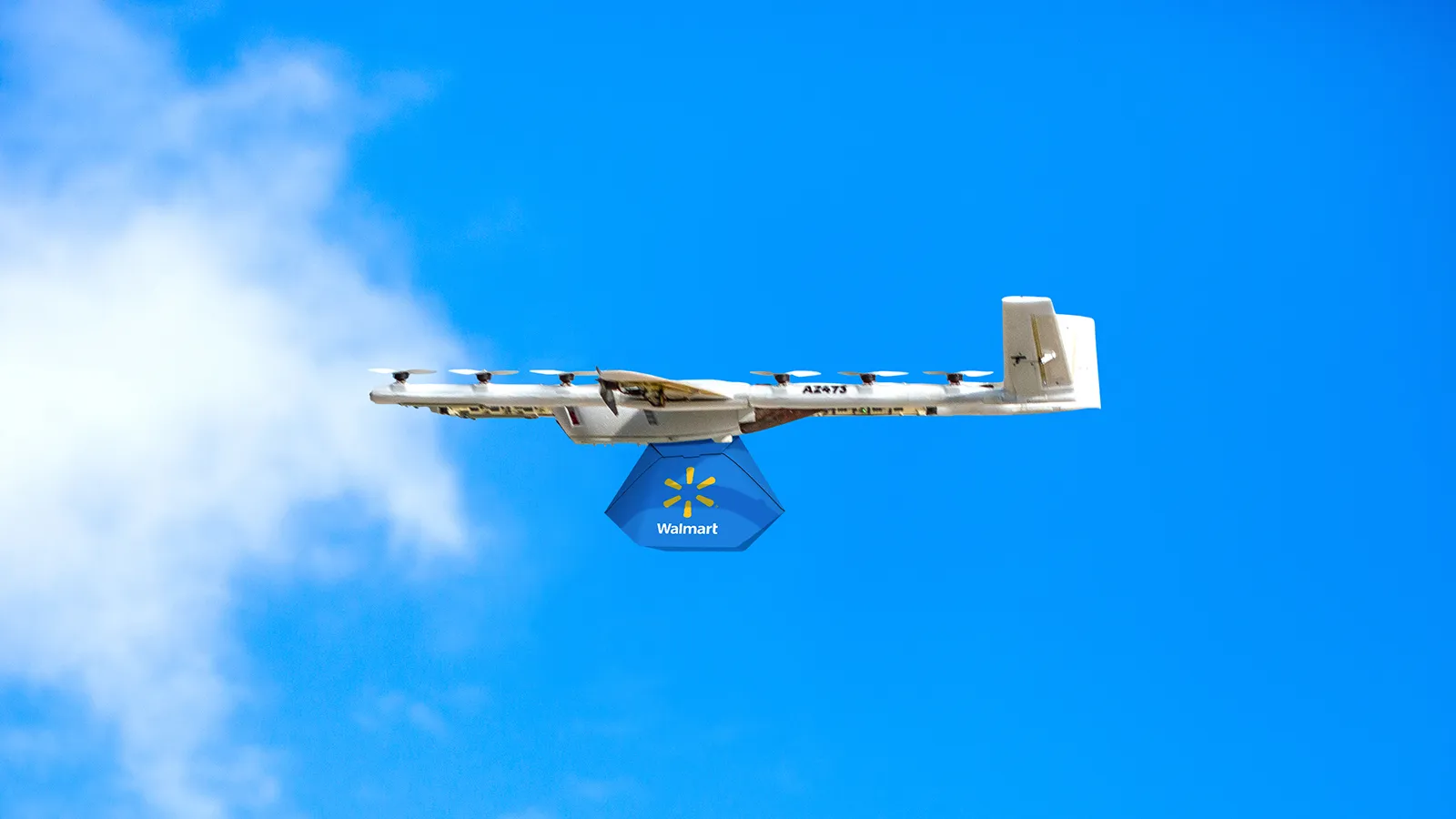

Efforts to satisfy customer demands also will continue to push forward product delivery solutions, including “last meter” delivery, according to Rick Jordon, a senior managing director at FTI Consulting.

“Consumers may be shopping digital channels first, but they are back in stores and incredibly frustrated when pricing is inconsistent or they can’t find in-store what they saw online—they are tired of doing the work."

Sonia Lapinsky

Partner and Managing Director and Leader of Fashion Retail, AlixPartners

Through this process, customers can have things shipped to them wherever they are. With companies like Amazon already experimenting with the technology needed for this type of pinpoint delivery, the trend isn’t going to slow down anytime soon, according to FTI Consulting’s Scalzo.

Labor and transportation costs will rise

Companies, particularly manufacturers, will face increased labor costs within their supply chains this year, according to Satish Damodaran, a senior managing director at FTI Consulting.

“The biggest challenge that I have seen with my clients and most manufacturing companies is shortage of labor, and especially skilled labor,” Damodaran said, creating a cascading effect of high turnover requiring more investment in recruitment and training.

Even with a resolution to East and Gulf Coast port labor talks, with some ocean shipping alliances shifting, rates could also rise this year, Dankert said.

“The biggest challenge that I have seen with my clients and most manufacturing companies is shortage of labor, and especially skilled labor."

Satish Damodaran

Senior Managing Director, FTI Consulting

On the ground, after a two-year decline, trucking spot rates began to climb toward the end of 2024, a trend that will likely continue in 2025.

“The general consensus is rates have bottomed, and they need to start coming up off the bottom, which obviously will lead to higher costs,” Jordon said.

Keep watch on cybersecurity and cargo theft risks

Companies that move freight, particularly retailers, have been forced to contend with an increase in cargo theft in recent years, putting drivers and products at risk. In Q3 2024 alone, cargo theft activity rose 14% year over year, accounting for more than $39 million in stolen goods, per CargoNet. Warehouse and distribution centers were the most targeted location type for cargo theft during the quarter, according to the report.

The threat has caused action at the federal level, with the Federal Motor Carrier Safety Administration introducing a new registration system this year while multiple acts of legislation are under consideration, including the Safeguarding Our Supply Chains Act.

Although that bill remains in committee, there is hope that more efforts will be made to address the issue this year, Dankert said.

Supply chain management professionals also need to be wary of threats to cybersecurity, an issue that disrupted supply chain operations multiple times last year, most notably through a ransomware attack on vendor Blue Yonder in November.

“I think supply chains, by nature, are a lot of connection points, and so there's potential for exposure there,” Dankert said. “So I know that our members are very much focused on cyber security as it pertains to supply chain.”

Especially given the increasing digitization of supply chains, the keys to ensuring cybersecurity protection will fall in line with the overall need for diversification and resilience.

“Having those redundant systems and protections in place is something that is vital,” said the NRF’s Gold.